dc income tax withholding calculator

Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Just input your employees W-4 and wage information and our calculator will process each employees gross pay deductions and net pay after DCs state and federal payroll taxes.

New Tax Law Take Home Pay Calculator For 75 000 Salary

Calculate your state income tax step by step.

. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 20002 District of Columbia INCOME TAX WITHHOLDING Instructions and Tables 2010 New Withholding Allowances for the Year 2010 The tables reflect withholding amounts in dollars and cents.

Yes No D-4 DC Withholding Allowance Certificate Detach and give the top portion to your employer. Washington DC Salary Paycheck Calculator. The amount you earn.

District Of Columbia Payroll Tax Rates Updated February 3 2022 As the capital of the United States Washington DC. Skip to main app content Step 1 incomplete Personal Info Step 2 incomplete Your Pay Step 3 incomplete Credits Step 4 incomplete Other Income Step 5 incomplete Deductions Step 6 incomplete Your Results. After a few seconds you will be provided with a full breakdown of the tax you are paying.

This breakdown will include how much income tax you are paying state taxes federal taxes and. Free Federal and District of Columbia Paycheck Withholding Calculator. Calculate your Washington DC net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington DC paycheck calculator.

Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. Find your gross income. The amount you earn.

Not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me. 2014 Income Tax Withholding Instructions and Tables. 2013 Income Tax Withholding Instructions and Tables.

Determine the dependent allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. 2010 Income Tax Withholding Instructions and Tables. Free Federal and District of Columbia Paycheck Withholding Calculator.

After a few seconds you will be provided with a full breakdown of the tax you are paying. The amount of income tax your employer withholds from your regular pay depends on two things. For help with your withholding you may use the Tax Withholding Estimator.

Filers get taxed 400 on their first 10000 of taxable income. Payroll calculator that will do all the work for you. Round all withholding tax return amounts to whole dollars.

Switch to Washington DC hourly calculator. Apply the taxable income computed in step 5 to the following tables to determine the District of Columbia tax withholding. Using our District Of Columbia Salary Tax Calculator.

Office of Tax and Revenue 941 North Capitol Street NE. Has relatively high income tax rates on a nationwide scale. Unlike the Federal Income Tax District of Columbias state income tax does not provide couples filing jointly with expanded income tax brackets.

Check the 2021 District of Columbia state tax rate and the rules to calculate state income tax. Find your pretax deductions including 401K flexible account contributions. This site is available 24 hours a day seven days a week.

District of Columbia collects a state income tax at a maximum marginal tax rate of spread across tax. Thats why we created a simple Washington DC. 2009 Income Tax Withholding Instructions and Tables.

District of Columbias maximum marginal income tax rate is the 1st highest in the United States ranking directly below District of Columbias. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. 850 up to 250000.

And 1075 for taxable income above 1 million. 2011 Income Tax Withholding Instructions and Tables. Find your income exemptions.

2012 Income Tax Withholding Instructions and Tables. 925 up to 500000. For employees withholding is the amount of federal income tax withheld from your paycheck.

The information you give your employer on Form W4. Dependent Allowance 1775 x Number of Dependents. Now is the easiest time to switch your payroll service.

Use tab to go to the next focusable element. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. And I qualify for exempt status on federal Form W-4.

Use the Washington DC bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method. 650 up to 60000. Try PaycheckCity Payroll for free.

600 on income between 10000 and 40000. You can learn more about how the District of Columbia income tax compares to. The information you give your employer on Form W4.

2015 Income Tax Withholding Instructions and Tables. The FederalState E-File program allows taxpayers to file their federal and DC returns electronically at. 975 up to 1 million.

The following pages describe and present analysis of the tax rates for the District of Columbia and the revenues generated by these rates. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. For help with your withholding you may use the Tax Withholding Estimator.

If claiming exemption from withholding are you a full-time student. DC Online Filing is a secure site that provides full calculation of District tax and credits and currently allows District residents to file the D-40 and D-40EZ individual forms for free.

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

District Of Columbia Paycheck Calculator Smartasset

Simple Tax Refund Calculator Or Determine If You Ll Owe

Hawaii Income Tax Hi State Tax Calculator Community Tax

Paycheck Taxes Federal State Local Withholding H R Block

Check Your Paycheck News Congressman Daniel Webster

Income Tax Calculator Estimate Your Refund In Seconds For Free

How Do State And Local Individual Income Taxes Work Tax Policy Center

What Is Local Income Tax Types States With Local Income Tax More

Unfiled Tax Returns Irs Taxes Tax Return Tax Prep

Delaware Taxes De State Income Tax Calculator Community Tax

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

What Are Marriage Penalties And Bonuses Tax Policy Center

Colorado Income Tax Rate And Brackets 2019

New Jersey Nj Tax Rate H R Block

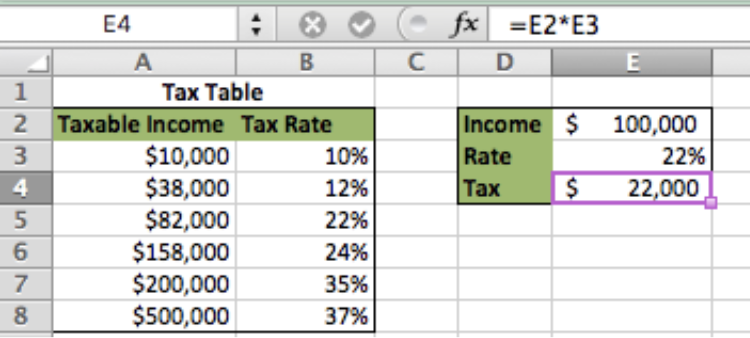

Excel Formula Basic Tax Rate Calculation With Vlookup Excelchat

New Tax Law Take Home Pay Calculator For 75 000 Salary

Turbotax Taxcaster Free Tax Calculator Free Tax Refund Estimator Tax Refund Turbotax Finance Apps